Standard Deduction Worksheet For Dependents 2019

For 2019 the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of 1100 or the sum of 350 and the individuals earned. The standard deduction for taxpayers who dont itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2020 than it was for 2019.

2018 Form 1040 Line 17a Worksheet

The amount depends on your filing status.

Standard deduction worksheet for dependents 2019. You can use the 2018 Standard Deduction Tables near the end of this publication to. The standard deduction for taxpayers who do not specify their deductions on Schedule A in Form 1040 or 1040-SR is higher for 2019 than for 2018. Dependent of another person Any filing status Any age More than your standard deduction Use the California Standard Deduction Worksheet for Dependents on page 10 to figure your standard deduction Requirements for Children with Investment Income California law conforms to federal law which allows parents election to.

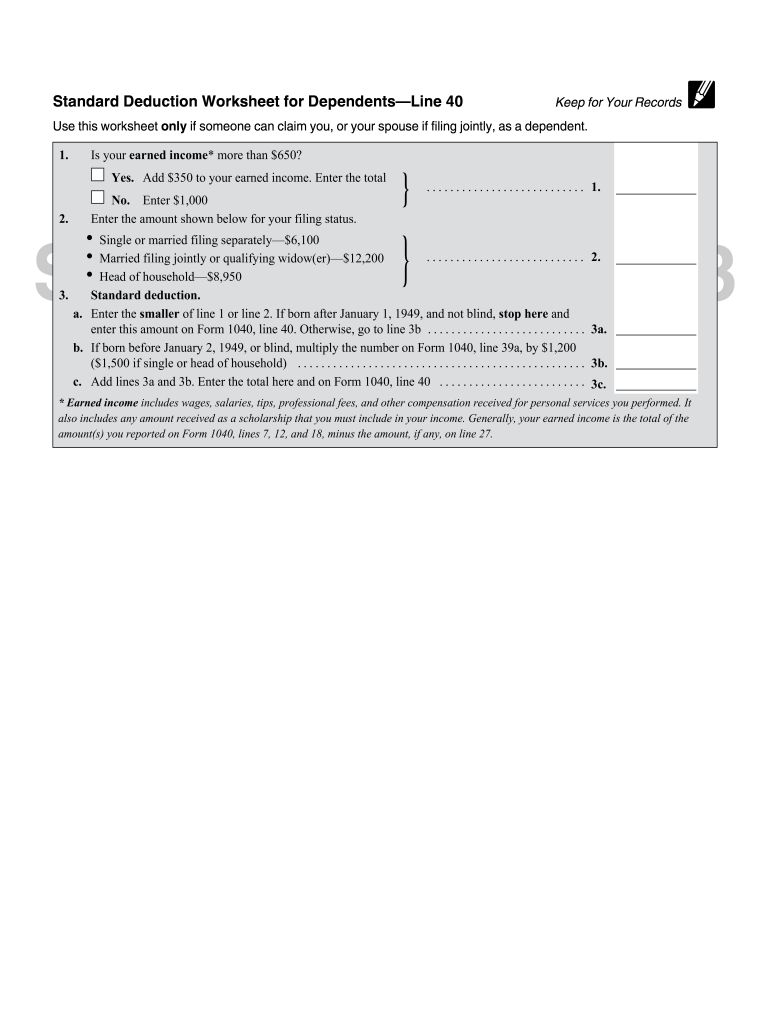

Line 1 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040. I otal number of boxes checked a. Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR.

Once completed you can sign your fillable form or send for signing. Form 1040 2018 Standard Deduction Worksheet for Dependents line 8. You can use the 2019 Standard Deduction Tables near the end of this publication to.

Your minimum standard deduction. Use Fill to complete blank online IRS pdf forms for free. Othenvise go to line 4b 1956 or blind multiply the number on line I by Sl 300 Sl650 if single or head of b.

Spouse was born before January 2 1954checked. On average this form takes 3 minutes to complete. You can use the 2020 Standard Deduction Tables near the end of this publication to figure your standard deduction.

Enter the larger of line 1 or line 2 here 3. The stand-ard deduction for taxpayers who dont itemize their deductions on Schedule A of Form 1040 is higher for 2018 than it was for 2017. The amount depends on your filing status.

This is your minimum standard deduction. SignNow has paid close attention to iOS users and developed an application just for them. The amount depends on your application status.

Standard Deduction Worksheet for DependentsLine 8Keep for Your Records Use this worksheet only if someone can claim you or your spouse if filing jointly as a dependent. Qualified business income de-duction. Enter the amount shown for your filing status.

Standard deduction amount in-creased. Enter your earned income from. Married filing jointly or Qualify-ing widower24400.

Enter your income from. The amount depends on your filing status. Standard Deduction Worksheet for Dependents 2019 Use this worksheet only if someone can claim the taxpayer or spouse if filing jointly as a dependent.

If born after Janua1Y I 1956 and not blind stop here and enter this amount on Form 1040 or Fom 1040-SR line 9. Single or Married filing sepa-rately12200. 1040-SR is higher for 2020 than it was for 2019.

Or from line A of the worksheet on the back of Form 1040EZ 1. If your filing status is joint or head of household Form 2 filing status 2 or 4 enter 4000. You can use the 2020 Standard Deduction Tables near the end of this publication to figure your standard deduction.

3550 as the sum of 3200 plus 350 is 3550 thus greater than 1100. However the standard deduction may not exceed the regular standard deduction for that individual. Basic standard deduction for 2020 will be 1100 same as for 2019 or 350 same as for 2019 plus the individuals earned income whichever is greater.

Il bom belre January 2. The amount depends on your filing status. 6 Enter here and on Form 2 line 42 the amount from line 4 or line 5 whichever is larger.

Enter the smaller of line 2 or line 3. For yourself your spouse or your dependents. The standard deduction for taxpayers who dont itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2019 than it was for 2018.

You can use the 2019 Standard Deduction Tables near the end of this publication to find out your standard deduction. Standard deduction for dependents If someone else claims you on their tax return use this calculation. Your standard deduction would be.

Minimum standard deduction 2. For 2019 the standard deduction amount has been in-creased for all filers. Form 1040 standard deduction worksheete or iPad easily create electronic signatures for signing a standard deduction worksheet for dependents in PDF format.

And Head of household18350. In 2020 you are allowed a charitable contribution de-duction of up to 300 if you dont itemize your deductions. Older and blind taxpayers.

If your income was 3200 you standard deduction would be. You were born before January 2 1954You are blind Total number of boxes 1. All forms are printable and downloadable.

1100 as the sum of 700 plus 350 is 1050 thus less than 1100. The standard deduction has been increased. For married taxpayers who are age 65 or over or blind the standard deduction is increased an additional amount of 1300 1650 if head of household or singleFor individuals who can be claimed as a dependent the standard deduction cannot exceed the greater of 1100 or the sum of 350 and the individuals earned income but the total cannot exceed the applicable standard deduction for the dependents.

Filing Status Trina S Tax Services

Revised Draft Publication For Computing Withholding By Employers Issued To Go Along With Draft 2020 W 4 Current Federal Tax Developments

What Is Standard Deduction In Income Tax With Example

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Fillable Online Apps Irs Standard Deduction Worksheet Line 40 Form Fax Email Print Pdffiller

Https Apps Irs Gov App Vita Content Globalmedia Standard Deduction Chart 65 Or Older 4012 Pdf

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Https Apps Irs Gov App Vita Content Globalmedia Standard Deduction Chart 65 Or Older 4012 Pdf

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Irs Standard Deduction Worksheet For Dependents Line 40 Fill Out Tax Template Online Us Legal Forms

Standard Deduction Worksheet For Dependents Fill Out And Sign Printable Pdf Template Signnow

1116 Frequently Asked Questions 1116 K1

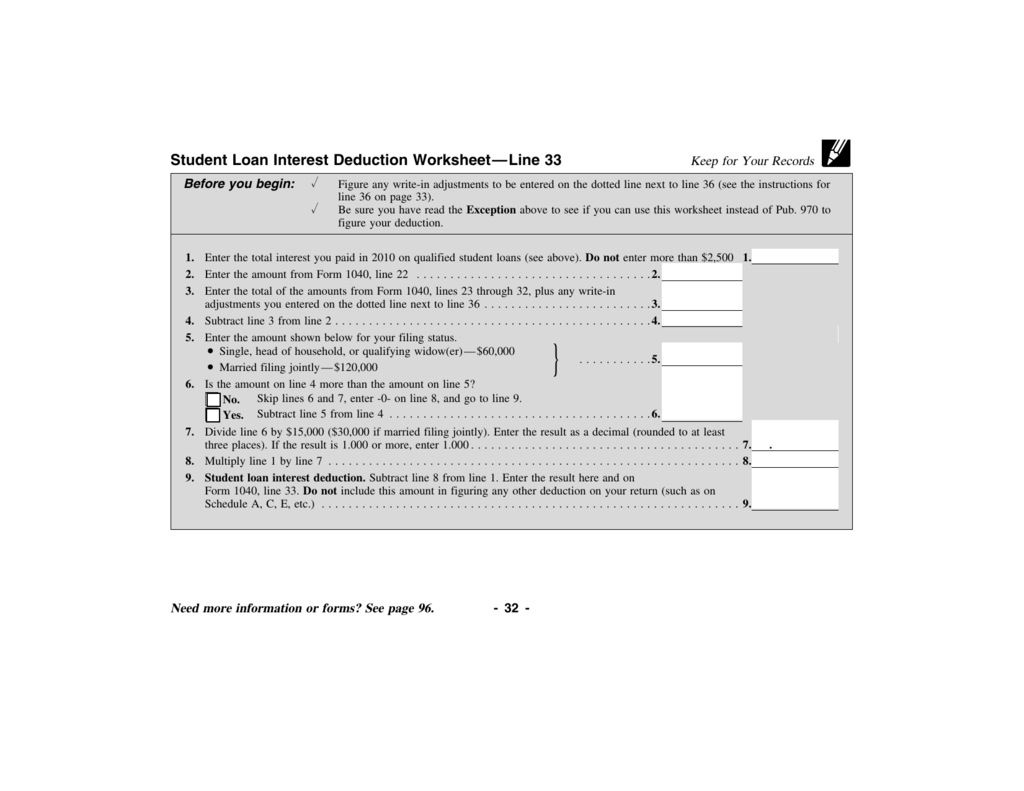

Student Loan Interest Deduction Worksheet Line 33

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign Printable Template Online Us Legal Forms

Fill Free Fillable Form 1040 2018 Standard Deduction Worksheet For Dependents Line 8 Pdf Form

More Individuals May Be Eligible To Claim Expanded Child Tax Credit For 2018

No comments: